How to Include Easter, Christmas, and Birthday Celebrations into My Budget?

Introduction

South Africans are known for their warm celebrations. Whether it's a joyful Easter, a festive Christmas, or a memorable birthday bash, we go big—and we go all out. But these special moments, as wonderful as they are, often come with a big price tag. Without proper planning, they can lead to debt, over-indebtedness, and financial stress that lasts long after the fun is over.

Here’s the good news: You can have your cake (and your celebration) and still keep your finances on track. This article is your ultimate guide to including your favourite celebrations in your budget—without breaking the bank.

How We Tend to Celebrate as South Africans

From the Cape Flats to Pretoria, Durban to Mitchells Plain—we know how to throw a party. But what’s common in all our festive moments?

1. Food, Food, and More Food

Whether it’s seven-colour plates, braais, biryani, or pap en vleis—hosting means feeding everyone. And that means full trolleys and full expenses (hello, VAT increase).

2. New Clothes for Special Occasions

Matching Christmas pyjamas, birthday dresses, or Easter outfits—these fashion moments cost money.

3. Decor, Gifts & Entertainment

Decorations, DJs, jumping castles, or long-distance travel to visit family can quickly add up.

4. Social Expectations

We want our children to have amazing birthdays and our families to enjoy. But without boundaries, celebrations can become burdens.

The Cost of Celebrations

Let’s break it down—because the true cost often hits after the party ends.

Expense CategoryBirthdayEasterChristmasFood & DrinksR1,500R1,200R3,000GiftsR500R300R2,000ClothingR400R300R800Travel & HostingR800R600R1,500DecorationsR200R150R300TotalR3,400R2,550R7,600

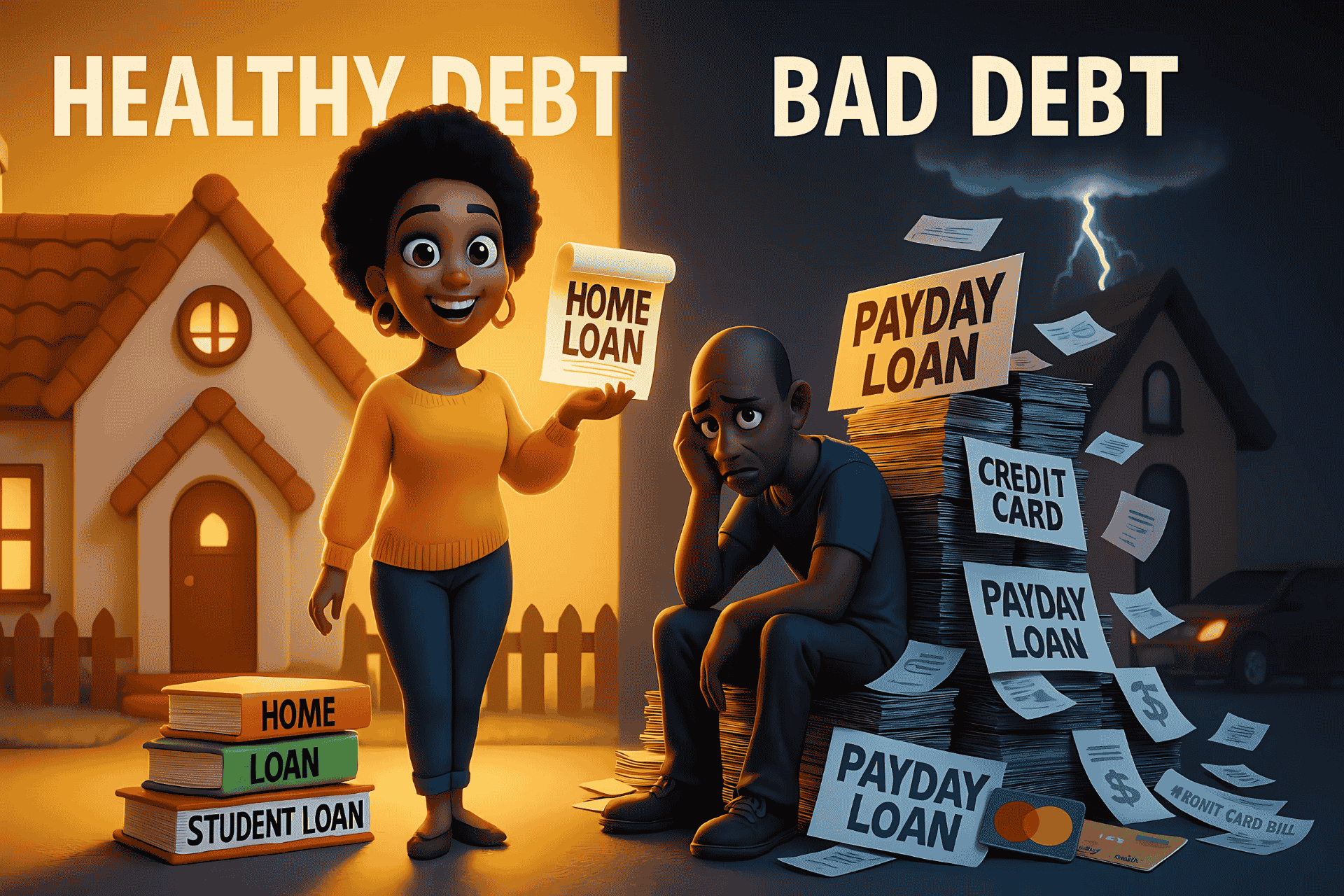

😰 Hidden Costs

- Using credit cards or payday loans

- Skipping debt repayments

- Borrowing money

- Falling behind on essentials

Before you know it, you're over-indebted and stressed, even considering debt review just to breathe.

Ramifications if Celebrations Become Too Costly

Celebrations should bring joy, not regret.

🚨 Financial Hangover

That great birthday or Christmas lunch might leave you:

- Behind on January school fees

- Skipping grocery runs

- Facing missed payment SMSes

⚠️ Emotional Pressure

Money stress can cause:

- Anxiety or guilt

- Family conflict

- Shame when debts pile up

But there’s a powerful solution: budgeting.

Budgeting as a Protective Tool

Budgeting isn’t about saying no.

It’s about saying YES to peace of mind and staying financially free.

How to Budget for Celebrations:

- Anticipate Events

Plan Easter, birthdays, and Christmas at the beginning of the year. - Break It Down

R3,000 for Christmas? Save R250/month from January. - Create a Celebration Fund

Use an envelope or separate account just for celebrations. - Protect Essentials

Never let a party threaten rent, transport, or school fees. - Track Spending

Learn from past overspending and adjust.

Budgeting helps you avoid dipping into loans, emergency funds, or entering debt review after one big event.

How to Celebrate in a Financially Responsible Manner

You can still throw a memorable celebration—without going broke.

🎉 Smart Celebration Tips:

- Keep it intimate: Invite fewer people for a meaningful, manageable event.

- Use public spaces: Host at parks or homes to save on venue costs.

- Potluck style: Ask guests to contribute a dish.

- DIY décor: Pinterest is packed with affordable, beautiful ideas.

- Group gifts: Everyone chips in for one meaningful present.

- Avoid last-minute shopping: Plan early to save.

- Reuse decorations: Be eco-friendly and frugal.

- Prioritise joy over cost: Games, stories, shared meals—that’s the real wealth.

Conclusion: You Can Celebrate and Stay Financially Free!

You don’t need a huge budget to create lifelong memories. You need a plan, creativity, and the courage to celebrate your way.

Celebrations like Easter, Christmas, and birthdays are about love and connection—not expense.

When you budget your big days, you protect your finances, your peace of mind, and your family’s future.

💬 Need Help Budgeting?

DebtCut is here to help you cut debt—not joy.

Visit our website or contact us today for budgeting help or to talk to a professional about managing credit agreements or entering debt review.

Discover Your Debt Relief Solution

Learn more about our debt relief services today

Read More of Our Latest Blog Posts

We take care to bring you only the highest quality information, right to your fingertips. Read more below:

Satisfied Customers

Read what our customers have to say about us.

"Thank you DebtCut! Thank you very much! You helped me take care of my family. I will not make debt again."

"DebtCut gave me a second chance. I was in so much debt that I couldn’t see a way out. With debt review and over time, I cleared all my debts. It’s a disciplined process, but it works!!”

Take Control of Your Finances Today!

Contact DebtCut today to learn how we can help you achieve financial freedom.