Debt Stress Doesn’t Discriminate

Introduction

Debt doesn’t care about your job title, your background, or where you live. It doesn’t ask whether you’re a teacher, a nurse, a young graduate, or a business owner. Debt stress can creep into anyone’s life — quietly at first — then louder and louder until it starts to affect your health, relationships, and peace of mind.

In South Africa, more and more people are finding themselves trapped in cycles of debt. Rising living costs, unemployment, and easy access to credit have made it easier to fall into the debt trap — and harder to climb out. But what many don’t realise is how deeply that debt begins to affect their mental and emotional wellbeing.

This article dives into what debt stress really is, who it affects, and how to take steps to break free. Because here’s the truth: debt stress doesn’t discriminate — but support is available for everyone.

What Is Debt Stress?

Debt stress is more than just worrying about money. It’s a heavy, ongoing pressure that doesn’t go away when you log out of your bank app or close the mail.

It’s:

- That anxious feeling when the phone rings

- The tight chest when another overdue notice lands in your inbox

- Waking up at 2am thinking, “How am I going to make it to month-end?”

Common emotional signs of debt stress include:

- Constant anxiety or panic attacks

- Trouble sleeping

- Feelings of hopelessness or shame

- Tension in your relationships

- Avoiding phone calls, bills, or bank statements

Debt stress is chronic — and until the root cause (unmanageable debt) is addressed, it won’t go away. It also impacts your physical health. Studies link debt stress to conditions like high blood pressure, ulcers, and heart issues.

What Causes Debt Stress?

There are many paths that lead to the debt trap — and not all of them are due to poor choices. Sometimes, life just happens.

Common causes include:

- Job loss or reduced income

- Medical emergencies or unexpected repairs

- Lack of financial education

- Easy access to high-interest loans and credit

- Supporting extended family while juggling your own needs

- Rising costs of living in South Africa

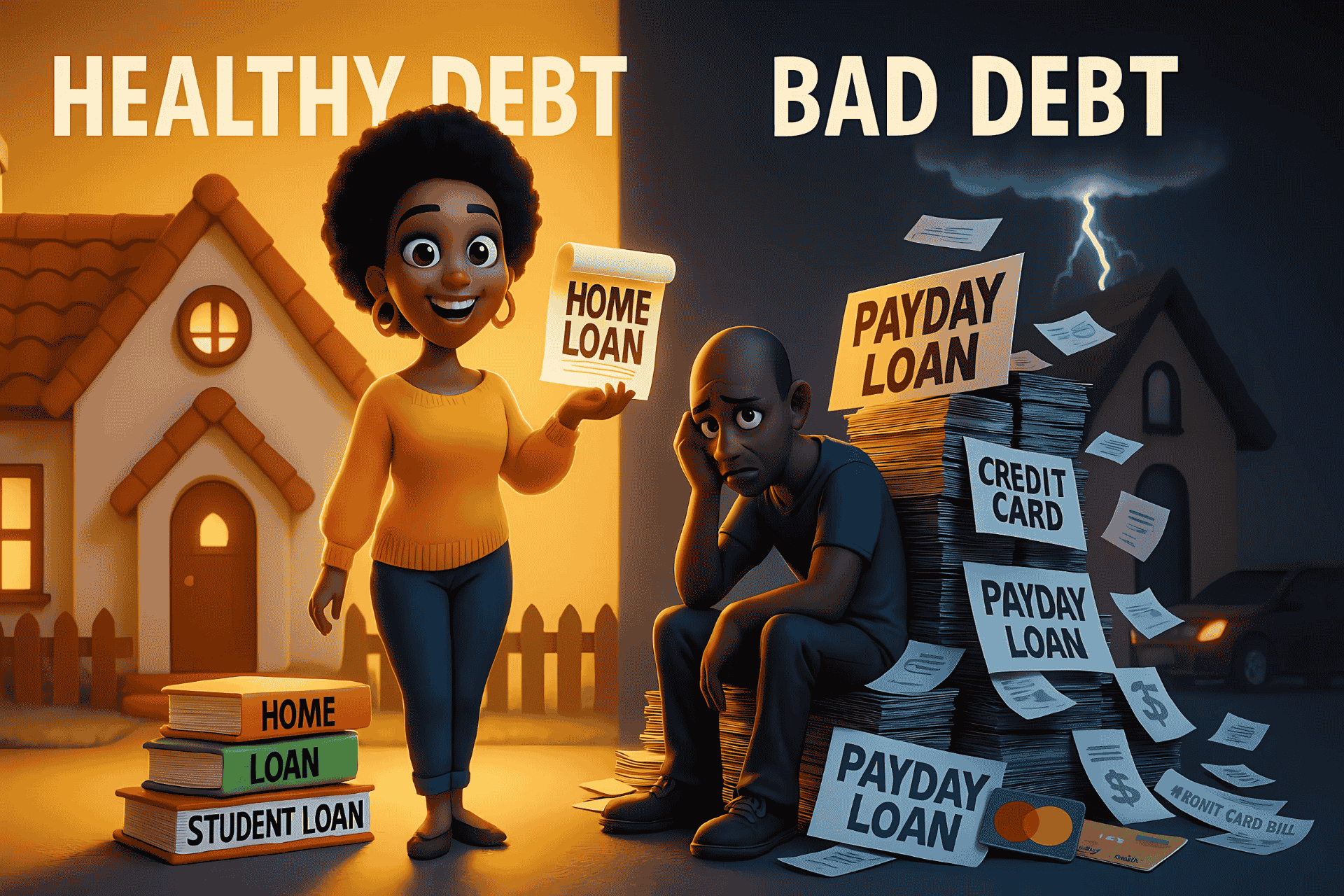

Often, debt builds slowly. A missed payment here, a payday loan there — until suddenly, it feels impossible to escape.

Who Suffers from Debt Stress?

Everyone. Debt stress doesn’t only affect the unemployed or low-income earners. It can impact:

- A graduate with student loans

- A parent juggling expenses

- A professional earning well but overwhelmed by obligations

- A retiree trying to stretch a pension

Even people who look financially stable may be secretly drowning in debt. The pressure to appear “successful” keeps many suffering in silence.

Debt Stress in Economic Classes

Debt stress looks different depending on your income level:

Low-Income Households

- Debt used for survival (food, electricity, rent)

- Reliance on mashonisas or high-interest loans

- Often trapped in repayment cycles

Middle-Income Households

- Overextension from car loans, school fees, and credit cards

- High risk of becoming over-indebted

- Fear of losing assets or lifestyle

High-Income Households

- Debt from large bonds or business obligations

- Shame and stigma prevent asking for help

- Debt stress hides behind luxury

Debt doesn’t care about your payslip — it’s how you manage what you earn that matters.

The Taboo of Debt in Social Circles

Debt is still a taboo topic, especially in communities where success is linked to status.

People are afraid to admit they’re struggling because of:

- Social pressure to “keep up”

- Shame or guilt

- Fear of being judged or pitied

The result? Silence and isolation. But silence only worsens the problem.

Talking about debt is the first step toward healing. When you speak up, you gain clarity and open the door to support — like debt review, financial education, and legal protection.

Remedy: How to Relieve Debt Stress

There is a way out — and it starts with action. Here’s what you can do:

✅ 1. Know Your Numbers

Request your credit report. Understand exactly what you owe and to whom.

✅ 2. Speak to a Debt Counsellor

At DebtCut, we assess your finances and help you:

- Create an affordable repayment plan

- Protect your assets

- Stop creditor harassment

✅ 3. Learn Your Rights

You may qualify for interest reductions, payment extensions, or legal protection under the National Credit Act.

✅ 4. Use Tools and Resources

Track your budget with apps or printables. Every rand accounted for gives you more control.

✅ 5. Talk About It

Share your struggles with someone you trust. You’ll realise you’re not alone — and that there’s no shame in getting help.

Conclusion

Debt stress is real. It affects your mind, your body, your relationships — and it doesn’t care who you are.

But here’s what it can’t take:

Your right to fight back. Your right to ask for help. Your right to reclaim peace of mind.

If you’re struggling, don’t wait.

👉 Visit www.debtcut.co.za to book a free, confidential consultation.

Together, we’ll cut through the stress and build a clear, affordable path to freedom.

You deserve a life without debt stress.

Let’s make it happen.

Discover Your Debt Relief Solution

Learn more about our debt relief services today

Read More of Our Latest Blog Posts

We take care to bring you only the highest quality information, right to your fingertips. Read more below:

Satisfied Customers

Read what our customers have to say about us.

"Thank you DebtCut! Thank you very much! You helped me take care of my family. I will not make debt again."

"DebtCut gave me a second chance. I was in so much debt that I couldn’t see a way out. With debt review and over time, I cleared all my debts. It’s a disciplined process, but it works!!”

Take Control of Your Finances Today!

Contact DebtCut today to learn how we can help you achieve financial freedom.